The failure of Silicon Valley Bank and the rescue of Credit Suisse are warning signs that investors should dismiss at their peril. While there is no immediate risk of a systemic bank collapse like the one that precipitated the global financial crisis, the banking troubles that have surfaced this month are symptomatic of a fundamental change in market regime that still has much further to run.

As with the gilts market crisis in the UK last autumn and the more recent collapse of the cryptocurrency exchange FTX, these recent episodes tell us that there is no going back to the easy money years that followed the global financial crisis, when inflation was quiescent and interest rates were deliberately held down below their natural level. (See the Opera of Canaries for my analysis of the gilts, FTX and SVB incidents).

Unfortunately there is little evidence as yet that investors are alert to the full significance of these headline-grabbing events, which appear to be isolated incidents, but in reality are all closely linked and stem from the same underlying causes. As in the past, shaking off the idea that the world has changed and everything will soon be back to normal does not come naturally to investors.

In my book The End of the Everything Bubble, published in 2021, I spelled out the reasons why after a decade of misguided monetary policy a big reset in asset prices was inevitable and why it would affect every kind of asset class, including bonds, equities and property. I did not know exactly when the reset would begin, only that it was imminent.

In the event the process began in 2022, when we saw simultaneous double digit declines in bonds and equities and blow ups in a number of more speculative markets, including bitcoin. With inflation surging to a peak of more than 10% in the US, UK and Europe, central banks have been forced to tighten policy abruptly.

Now inflation is coming down, but there is a long way still to go and the losses faced by investors are bound to ratchet up further before the reset is complete. The financial markets face at least two more serious inflection points as awareness of the underlying problems widens. Every historical precedent suggests that it will not be for some time before investors capitulate and more attractive opportunities for value investors in equities and other asset classes emerge.

Market background

The unwinding of the great liquidity injection is still in its early phases. The first phase was initiated by inflation warning us that the zero cost of money could not go on indefinitely. This caused a meaningful setback in all asset markets through 2022. However, the ‘free ’money period has lasted so long that the markets’ addiction to these liquidity injections still remains and with it also remains the investing ‘rule book ’that investors learned to follow during the period.

This rulebook still guides market reactions. What markets desire now is return to the halcyon days that followed the global financial crisis. For this reason, attention has largely remained focused on inflation. The logic runs that once inflation falls, central banks will immediately drop short rates, bond yields will decline, governments will stimulate and the investment party can resume.

The first quarter of 2023 has given us a microcosm of this. Headline inflation in the US has moderated as previous price increases, particularly in energy, arithmetically drop out of the annual number. Similarly, there has been a slight moderation in core inflation. However, the context is all important here.

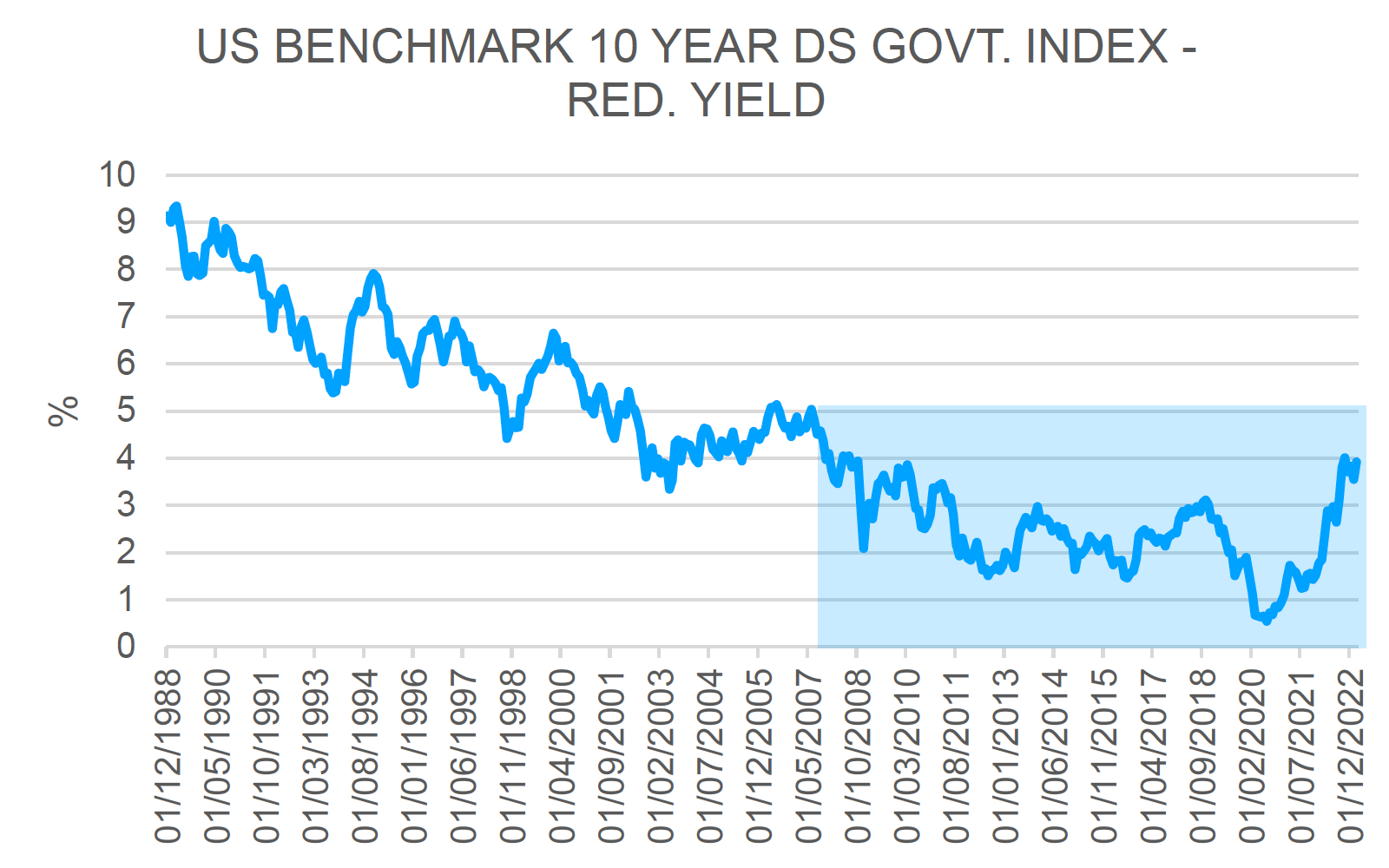

Core inflation is still higher than at any time since the mid 1980s. For the sake of argument, let us assume that it does fall back to the 2% range of the past 30 years (although to do so requires skipping over the arguments about poor demographics, lack of labour migration, dual/triple sourcing and potential trade conflicts that would all serve to undermine that assumption). The last time inflation was consistently at 2%, the US ten year bond yield was broadly in a 4-6% range.

This suggests that the current yield of just under 4% is more likely to mark the bottom of the likely future range rather than the peak. While nominal interest rates are higher than they were during the QE years, they remain low by historic standards (and still negative in real terms). Global monetary policy has tightened, but looking at interest rates in isolation it is not obviously ‘tight’ in absolute terms. The probability that rates will fall back sufficiently to reignite the animal spirits of the post-GFC bubble is very low.

If you accept the assumption that all bond yields and interest rates have done is move back to the bottom of the previous normal range, it follows that the world faces serious fiscal issues. For example, Congressional Budget Office forecasts suggest that on its current path the US budget deficit will continue to widen until interest payments on debt eventually exceed 7% of GDP, which is larger than entitlement programmes such as Medicare.

Of course, the CBO’s forecasts are a simple extrapolation of current policies rather than an actual forecast per se, but they do highlight the unsustainability of the current fiscal path, even given a set of rosy assumptions. What this means is that fiscal retrenchment is now unavoidable. The only negotiation to be had is about the process and terms of how it can be achieved.

Perhaps the term ‘negotiation’ does not do justice to what is likely to unfold. For many years politicians have faced few binding constraints on the fiscal front and have therefore been able to promise electorates that governments can solve most issues, including pandemics and energy costs. That implied ‘contract’ will now however have to be broken, which in turn will bring with it political turmoil.

How the turmoil unfolds will vary from country to country, but investors need to factor this political factor into their decisions, since a charged political environment gives voices to the political extremes. This can easily impact business operating conditions through changes to taxation and labour laws, to mention just two obvious examples.

Markets and the rear view mirror

This is all still to come but the early signs are already there, as the political storm over pension reform in France demonstrates. For the moment we continue to operate in a market that is being driven by reference to the rear view mirror. Inflation is not the issue, as it will surely recede. The problem is that it will most likely recede because economic conditions are going to be so much worse than the market seems to expect. It stretches credulity to expect a “soft landing”, given the investment, consumption and debt patterns we have seen since the financial crisis.

There are also particular concerns about many of the financial structures which were created during the long years of suppressed interest rates. While there have been some examples based

primarily on liquidity issues (such as the pension fund crisis in the UK in autumn 2022), we should expect many more to emerge as economic conditions worsen and funding costs rise.

Currently the markets are reacting in an exceptionally positive manner to any sign that inflation is falling. It is unfortunately quite normal for markets to ignore the time lags associated with policy changes and their economic impact. It is also common for market participants to try to return to previous investment playbooks even when the underlying conditions have changed. Institutional

memory is hard to shift.

We are currently in the tightening phase of policy, but at a point where the economic impact of tightening has yet to be fully felt. The absence of an immediate economic reaction allows markets to follow their historic tendency and remain overly optimistic. On past form, this will only crumple when the lags have worked their way through. The next phase of this journey will be a gradual drip of poor economic news.

No return to QE

Paradoxically, markets may initially take this positively. The post-GFC environment has been one in which any sign of economic weakness has prompted fiscal and monetary intervention of

meaningful proportions. This is no longer possible, nor likely to be effective. One reason is that central banks and fiscal authorities will be constrained from loosening policy for both inflation and debt overhang reasons.

A second is that even if looser policy can be introduced, it may not be sufficient to overcome some other consequences of post GFC policy. The re-appearance of inflation last year was the first of what are likely to be a series of inflection points as the world slowly adapts to a new reality.

The second inflection point waiting in the wings is when we start to see the full effects of misplaced investment decisions driven by the long period of suppressed interest rates. Bankruptcies and defaults will pick up. This will constitute further tightening as the risk premium demanded by lenders rises in response to defaults and the availability of money to lend declines.

The markets will turn from worrying about inflation to focusing instead on the outlook for growth, profits and solvency. This will be when the next phase of the bear market begins, and when more interesting new investment opportunities also begin to appear as valuations move closer to historic lows and what John Templeton used to refer to as ‘the point of maximum pessimism’.

If this is correct, the implications are:

- It is too early to increase equity exposure and current valuations do not justify it. We need to remain patient and wait for this to unfold even as markets rally;

- There may be some shorter-term opportunities, but we must remain vigilant on them and be careful with cyclical and energy exposure given the economic outlook;

- The main activity needs to be building a ‘watch’ list for the securities we want to buy so that we are ready when the market declines take place;

- The fiscal issues facing governments are going to become increasingly politicised as the fight between expenditure reduction and taxation increases plays out.

The lesson for markets is that illiquidity and leverage are extremely dangerous bed fellows. Sadly, whilst it may not be a new lesson, it is one which never seems to be absorbed. Human nature, combined with the incentives and constraints inherent in money management, dictate that buoyant asset prices and a low cost of money typically cloud both the memory of historical precedents and current perceptions of risk.

What next?

As we work our way through what will be a difficult market environment, policy will in due course be loosened, but a time lag will again come into play. There will be no immediate recovery in the global economy, which on past precedent will then give rise to a prevailing market view that policy is not working.

My view is that the bear market in equities is through the first phase of its decline and the most recent rally is not sustainable. Persistently poorer economic news is likely to emerge in the second half of the year, leading to a marked deterioration in investor sentiment. The emergence of this kind of gloomy sentiment and commentary would be a signal that the trough of the bear market is imminent.

Emerging attractive valuations will, on the whole, be ignored, with the majority of investors constrained by a lack of liquidity on the one hand and concerns about being ‘too early ‘ ’on the other. This will be the final ‘capitulation’ phase of the cycle. It will only be in the final ‘capitulation ’phase that value investors like us will wish to be fully invested in instruments with the greatest upside. This is certainly the roadmap that Global Opportunities Trust intends to

follow.